Latest on Coronavirus Early Super Release

September 14, 2020

As part of its COVID-19 economic response, the Federal Government is allowing eligible Australians to access some of their superannuation early. On 3 September 2020, regulations were implemented to extend the temporary early access to super provision until 31 December 2020. This means that a release application for an amount of up to $10,000 may still be lodged up until the end of this year.

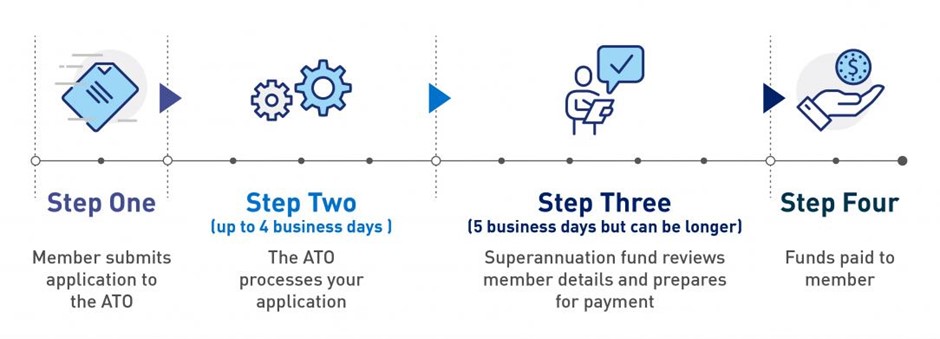

Provided you meet the eligibility criteria, the application process for the early release of super is fairly straightforward, and the funds are received within a relatively short period of time. The infographic below summarises the process.

Source: The Australian Prudential Regulation Authority (APRA)

A substantial amount has already been withdrawn from the superannuation environment under this temporary measure. The Australian Prudential Regulation Authority (APRA) has recently published the latest data on the temporary early release of superannuation scheme. Over the period from the inception of the scheme on 20 April to 30 August, payments made to eligible members totalled $32.6 billion.

Source: The Australian Prudential Regulation Authority (APRA)

As a result of the financial hardship caused by coronavirus, access to super may be an important way to help you make ends meet at a difficult time. Before taking this step, it is important to weigh it against other options that may be available to you and consider the possible long-term impact of the withdrawal. Super is designed to pay for your life in retirement, so withdrawing money from it now is likely to affect your retirement capital.

There is a debate on the actual impact of early access to super on retirement capital, which ultimately can affect your retirement lifestyle. The impact can be quite substantial for some but minimal for others. The factors that can influence the outcome include:

- How much you withdraw

- How the withdrawn money is used: some people may need to spend the entire withdrawn amount, but some may use any remaining funds to reduce their debt

- How your super is invested: this determines the compound return that your super is expected to generate between now and retirement

- Your age and years to retirement: if you are younger, the impact is likely to be more severe, when compared to someone who is retiring next year – younger people will forgo more of the compound return

Moneysmart have designed a calculator that can help you to see the potential impact of early withdrawal on your retirement savings.

If you had to withdraw some money from super, you can still rebuild it over time with the right mix of strategies, including:

- Sacrificing pre-tax salary into super: this can rebuild your super over time with your pre-tax earnings

- Making a small contribution after tax to receive co-contribution: if you meet the requirements and make personal after-tax contributions of up to $1,000 pa, the Government will also contribute up to $500 into your super account – which is up to a return of 50%!

- Making a spouse contribution and receiving a tax offset: if you make an after-tax contribution into your spouse’s super account and he/she earns less than $40,000 pa, you may be eligible for a tax offset of up to $540

- Making personal contributions and claiming a tax deduction: this works similar to salary sacrifice, but the tax benefit from this strategy is deferred until you lodge your tax return

- All of the above

A word of caution, though, to those who are planning to withdraw their super and then recontribute it back to gain a tax advantage. The ATO has recently started issuing letters to individuals who have accessed superannuation early through the COVID-19 early release program and made personal contributions back into superannuation. Where the main purpose of withdrawing the funds was to obtain a tax benefit, the ATO can remove the benefit derived and apply additional penalties.

Source: The Australian Taxation Office (ATO)

If you have questions in relation to the temporary early access to super provision or how to rebuild your super, please give us a call or drop us an email.