Accessing Superannuation

February 16, 2016

In Australia, it is compulsory for employers to contribute at least 9.5% of ordinary earnings into a superannuation account. This money is then locked away until “retirement”. But what exactly is “retirement” and what other situations are there when can funds in superannuation be accessed?

In order to access funds in superannuation, you need satisfy a condition of release. Typically this involves one of the following:

- Attaining age 65

- Leaving an employer after the age of 60

- Attaining preservation age (currently 56) with no intention of working again

- Death or Terminal Medical Condition

- Permanently Disabled

- Severe Financial Hardship

- Compassionate Grounds

- Account balance of $200 or less

- Temporary resident leaving Australia

Most of those conditions are ones that we would prefer never to utilise. We would rather not be suffering severe financial hardship, or be permanently disabled but it’s good to have them there just in case.

The three main conditions that people utilise are the first three and we will discuss these in more detail.

Age 65

Attaining age 65 is straight forward. You don’t need to have stopped work. You can access the funds in your super account anytime you want.

Leave an Employer After Age 60

Leaving an employer after age 60 is often overlooked by many people. If you worked a second job and gave that up after age 60, you can still access your super despite not being retired from your main job. Similarly, if you change employers after age 60, you can access super even though you have not retired. This might allow you to change jobs to one that is less physically demanding and accessing the super could allow you to clear the mortgage so that you can still manage on a lower income.

Preservation Age and Permanently Retired

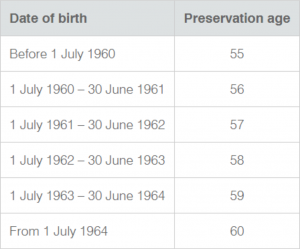

The government is in the process of increasing the age at which superannuation can potentially accessed from 55 to 60. To determine the age which applies to you, you look up the following table:

Once your preservation age has been reached, you can access the superannuation if you retire and have no intention of working again. It is important to realise of course that you are allowed to change your mind. So long as you genuinely intended to stay retired at the time of the declaration, you are able to go back to work if you have a work offer too good to pass up, decide that your existing capital is not going to be sufficient or even are just bored.

Transition to Retirement Pensions

Although not classed as a full condition of release, it is also possible to get partial access to superannuation once you reach preservation age (currently 56) even if you are not retired. Generally, you can use your superannuation to commence an income stream that pays you between 4% and 10% of your account balance each year. Whilst tax is a consideration, this may be attractive if you want to reduce your work load or take a temporary work break (eg for health reasons). After 60, these pensions can be very attractive because the income they pay becomes tax free.